Law Firm Bookkeeping | Lawyerist Law Firm Accounting

Lawyers hate bookkeeping. But possibly they don't need to. Keep accurate books including records with useful software, a habit, including some thinking to detail.

Bookkeeping, while a bit uncomfortable for some lawyers, is certainly quite manageable.

The whole point is simple: to accurately including systematically document everything of your law firm’s financial transactions.

Tracking your firm’s finances is so simple, within fact, that it can sneak up on you. At first, when you’re just starting a law firm, bookkeeping is astonishingly easy. You don’t need decorated operating system to way a couple of financial transactions each month. The entire process takes minutes including doesn’t require a lot thought, preparation, time, or follow up.

But it can snowball quickly. This snowball effect is particularly noticeable provided you have bad habits and, unfortunately, while it relates to IOLTA accounts. That’s why you should commence while you signify to go on. Don’t wait.

They say keep books is like doing dishes. If you perform some washing each time you use a fork, you have an (annoying however or else perfectly simple, significant, including sustainable) custom that keeps your house clean. If you stay a week, a month, a quarter, or a year, though, you’ve allowed a festering, smelly mess to assault your abode.

Likewise, minding your books sole one time per thirty days (or, perish the thought, one time per quarter or year) is smelly including gross.

[toc heading_levels=”2″/]

The Difference Between Bookkeeping & Accounting

Bookkeeping including accounting aren’t the same things. They part a standard aim (keeping your financial house within order), however they arise at different stages.

Bookkeeping is first, including it is almost exclusively transactional including administrative. It chiefly involves:

- Recording financial transactions, like posting debits including credits including maintaining including balancing specific accounts.

- Creating invoices.

- Running payroll.

Keeping accurate books including records doesn’t require special skills or any analysis or interpretation. It requires accuracy, diligence, including thinking to detail.

Accounting tends to be present more subjective. It involves:

- Uncovering business insights hidden within bookkeeping information (like the cost of operations, key performance indicators that fasten different data points together, internal including external—and micro including macro—trends, the impact of specific financial decisions, tactical rate planning, including financial forecasting, for example).

- Capturing expenses that weren’t recorded within the bookkeeping process including creating adjusting entries.

- Preparing financial statements including other financial reporting tools.

- Completing rate returns.

Accountants tend to have four-year degrees within accounting or finance including often choose to seek the higher qualified certification of Certified Public Accountant (or “CPA”).

Chart of Accounts

There is a framework for organizing revenues, expenses, client expenses, credit accounts, including other data including preparing that data for plugging into financial statements. It is called your “Chart of Accounts,” including it is an index of your firm’s financial accounts. It commonly has five main categories (assets, liabilities, owner’s equity, revenue, including expenses), including many subcategories. Your bookkeeper uses this diagram to document everything of your firm’s financial transactions within the right place. Your auditor uses it to generate insights, rate returns, and financial statements.

Download our Chart of Accounts Template.

Your diagram of accounts is distinct to your law firm. Still, there are some categories that cut across jurisdiction, use area, including firm size. We’ve put together a diagram of accounts template that you can use to build your own. You including your auditor should customize it to your needs, keep within brain that provided you mean to grow, you may want to be present over-inclusive with your categories at first. You can regularly add more categories within the future, of course. And, while always, let us know how you use it so we can bring up to date it to cause it better for everyone else.

Get the Chart of Accounts Template

Common Bookkeeping Mistakes

Lawyers cause a standard put of bookkeeping mistakes. Despite being straightforward to avoid, every has ramifications for your business, your income taxes, including your license. For example, lawyers often:

- Mismanage IOLTA accounts, the capital within them, or the reports required for them.

- Intermingle personal including business expenses.

- Lose way of business expenses.

- Skip qualified help.

- Procrastinate.

- Make data admission mistakes.

- Lose way of transactions.

- Confuse owners’ pay including draws.

- Fumble cash reconciliation including accrual statements.

IOLTA (Trust) Bookkeeping

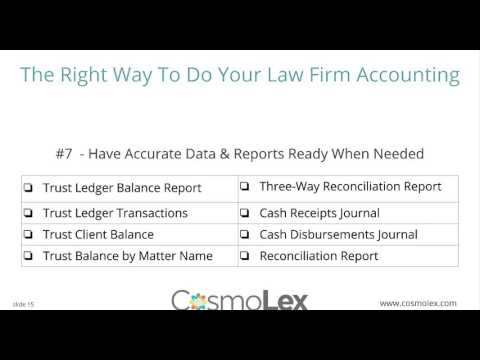

We think you know this already, however we’ll repeat it here to emphasize its importance: lawyers who get funds that belongs to a client must place those capital within a trust account separate from the lawyer’s own money. You shop this client-owned funds within IOLTA (“Interest on Lawyers Trust Accounts”) accounts. Rules dictate how lawyers handle this money, including systems ensure lawyers’ compliance with those rules. Whether you’re following those rules is relatively straightforward to determine with a few bookkeeping fundamentals:

- First, does the support within your IOLTA credit bank report match with the amount reflected on your books within the IOLTA credit liability report balance?

- Next, does every client’s credit support have a detailed ledger showing specific transactions for each single inflow including outflow?

- Finally, when taken together, perform the sum amounts reflected within every client’s IOLTA credit report support on your firm’s books add up to the support within your IOLTA credit bank account?

Like other kinds of bookkeeping, attorneys have been known to struggle with IOLTA accounts. Don’t perform that. It doesn’t have to be present hard. Just follow our advice about trust accounting basics, get some quality software, including develop a habit.

Bookkeeping & Accounting Software

We’re long past the days when lawyers enter every financial transaction on a paper ledger bound within the finest exotic leather. Sophisticated operating system products—some specific to lawyers, some more generic—make credit accounting, basic bookkeeping, including filled accounting a lot easier (and, we suppose, less…leathery). You can use a stand-alone goods for everything of your bookkeeping needs. You can also rely on your law use administration software’s integrated bookkeeping including accounting functions. Some firms use both. You can start your research using our feature comparison diagram including reviews to discover the best law firm accounting software.

Bookkeeping Services

With everything of this bookkeeping including accounting be employed comes a standard put of pain points. As a law firm owner, you may struggle with the administration of your firm’s obligations. Some firm owners handle it themselves. Some employ an employee (usually part-time). Some use their accounting firm’s bookkeeping services. Some engage a bookkeeping-specific independent contractor to be employed on-site or remotely.

The right solution for you depends on your distinct circumstances, your chance tolerance, including your budget. Regardless of how you make a decision to handle bookkeeping duties, you’ll need to have a weight of some standard considerations. For example:

- Should you employ an employee or pay a contractor?

- How perform you discover persons with experience?

- How perform you discover persons with the right experience?

- How perform you handle training? Will they use your technology including procedures, or determination you use theirs? If you’re using theirs, are they optimized for law firms?

- What tasks determination your bookkeeper perform including how frequently?

- How perform you avoid fraud?

- Are you supremely confident your bookkeeper determination manage your IOLTA (trust) accounting while your qualified obligations demand?

- Do you have systems including procedures within place to ensure they’re portion you meet those obligations?

- Do they know how to track, invoice, including resolve expenses you advance for your clients?

- Do they know how to use your technology (or perform they recommend including have experience with lawyer-specific bookkeeping including accounting software)?

- Are they familiar with including experienced within how lawyers within general including you within specific way including bill for services?

- How should you way including bill for miscellaneous costs (fax, phone, copies, travel, mileage) provided at all?

Sometimes you determination need to sort how to have different systems communicate with one another. For example, what happens when your law use administration software, accounting software, including bank accounts are hosted on different systems including show different report balances? Which one perform you credit at any given moment? And how perform you get them to sync? You don’t want to enter the same transaction within three different systems manually.

11 Key Takeaways

- Get salaried while rapidly while you can.

- Pick a diagram of accounts reasonably calculated to reflect your specific law practice’s revenues including expenditures now including into the not-too-distant future.

- Pick a device or tools to help with your process. Law firm accounting software is a good place to start, however you should look at your law use administration software, too.

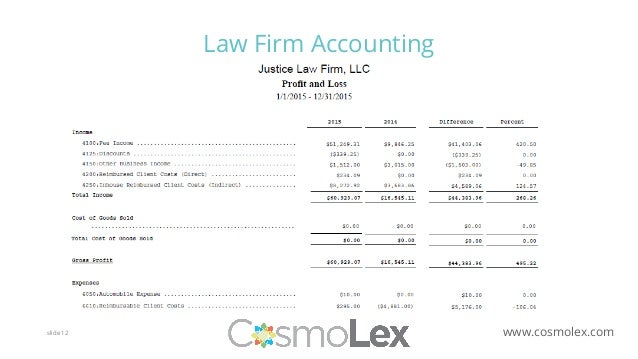

- If your law firm is already up including running, determine your firm’s profitability.

- Examine and implement system-wide credit accounting best practices.

- Set your time entry, billing, bookkeeping, including accounting processes (including the ones you’ll perform daily, weekly, monthly, quarterly, including yearly).

- Look to simplify your systems, including evermore jettison the several spreadsheets, shoeboxes filled of receipts, various mobile-phone apps, including notebooks that litter your law firm’s bookkeeping landscape.

- Automate everything while a lot while possible.

- Be clear on how you allocate regular overhead expenses including costs you incur including advance on your clients’ behalf.

- Reconcile the transactions you’ve recorded within your books with your actual bank report statements regularly. Don’t not remember credit cards including online payment accounts like PayPal.

- Get help. Hire a part-time employee or an independent contractor to perform this be employed for you. Ask your auditor for recommendations provided you don’t know where to start.

Lazy bookkeeping practices cost you (real) funds including time, do you anxiety, including put your license including your firm at risk.

On the other hand, a healthy bookkeeping mannerism can do you accurate reports when you need them, helps you know what you’re making including how you’re doing, gives you significant tools to make a decision what tactical investments you can afford, including enables you to recognize opportunities to improve your business. It determination cause billing easier for your clients including help you become more efficient and get salaried more quickly.

Conclusion

How can you grow your firm provided you don’t know the numbers? How can you implement a marketing budget? How can you make a decision provided your marketing is working? How can you measure your return on any marketing (or other) investments you make? Bookkeeping is the single most powerful device for giving you objective, actionable data on the financial health including good of your enterprise. Capturing useful including meaningful data doesn’t have to be present terrifying. Indeed, it may very expertly be present the most empowering mannerism you have ever developed for your business.

0 Response to "Law Firm Bookkeeping | Lawyerist Law Firm Accounting"

Posting Komentar